Why This Bridge Matters: CBSE Economics and the AP World

For many students in CBSE classrooms, economics starts as a clear, structured story: demand and supply graphs, market types, and policy ideas explained in crisp chapters. Transitioning to the College Board’s Advanced Placement courses—AP Microeconomics and AP Macroeconomics—invites you to tell those same stories with more detail, deeper graphs, and sharper policy narratives. This post is a friendly, practical guide that helps you carry your CBSE strengths forward while building the analytical and exam-ready skills that AP graders love.

What you’ll get from this guide

- A narrative framework to connect CBSE topics to AP Micro and Macro.

- Clear explanations of monetary and fiscal policy with classroom-friendly examples.

- Study and revision strategies that fit both board-style learning and AP exam formats.

- A sample study plan and a simple table to track progress.

- Notes on how personalized tutoring (like Sparkl’s 1-on-1 guidance) can accelerate your learning.

Mapping CBSE Economics Concepts onto AP Micro and Macro

CBSE gives you the vocabulary and intuition: opportunity cost, price elasticity, market structures, and aggregate concepts. AP courses expect you to expand those ideas. Think of CBSE as building your toolkit; AP asks you to build models with the tools and to communicate results precisely.

Microeconomics: From Individual Markets to Strategic Thinking

CBSE’s coverage of demand, supply, price controls, and elasticity maps directly to AP Micro. The AP exam pushes further: you’ll analyze producer and consumer surplus, deadweight loss, and imperfect competition at a deeper level. Also, AP Micro asks for a clear explanation of diagrams and the ability to tie graphical shifts to real-world consequences—skills you can practice with CBSE examples.

Macroeconomics: Turning Aggregates into Policy Stories

CBSE introduces students to national income and basic fiscal ideas. AP Macro expands this into the realms of GDP measurement, unemployment, inflation, and the IS-LM/AD-AS frameworks often used to tell coherent policy stories. This is where monetary and fiscal narratives come alive: the same terms you learned in school become the actors in nationwide economic dramas.

Monetary Policy: The Central Bank’s Toolkit—Told Like a Story

Monetary policy feels abstract if you only memorize tools. Turn it into a narrative: the central bank as a thermostat. When the economy overheats (high inflation), the central bank turns down the heat by tightening policy. When growth stalls, it relaxes policy to warm things up. That simple image helps you remember what each instrument does and why it matters.

Core Instruments and Their Effects

- Open Market Operations: Buying government bonds injects liquidity—interest rates fall; selling soaks up liquidity—rates rise.

- Policy Interest Rate (e.g., Repo Rate): The benchmark for short-term borrowing. Lowering it encourages borrowing and investment; raising it cools demand.

- Reserve Requirements: Changing banks’ required reserves alters how much they can lend—higher requirements shrink lending, and vice versa.

- Forward Guidance and Unconventional Tools: Announcements about future policy and tools like quantitative easing can shape expectations and long-term rates.

When answering an AP Macro question, link the tool to three things: (1) interest rates, (2) aggregate demand (AD), and (3) real economic outcomes (output and inflation). A crisp sentence like, “When the central bank buys government bonds, interest rates fall, investment rises, AD shifts right, and real GDP increases in the short run” scores well because it shows the causal chain.

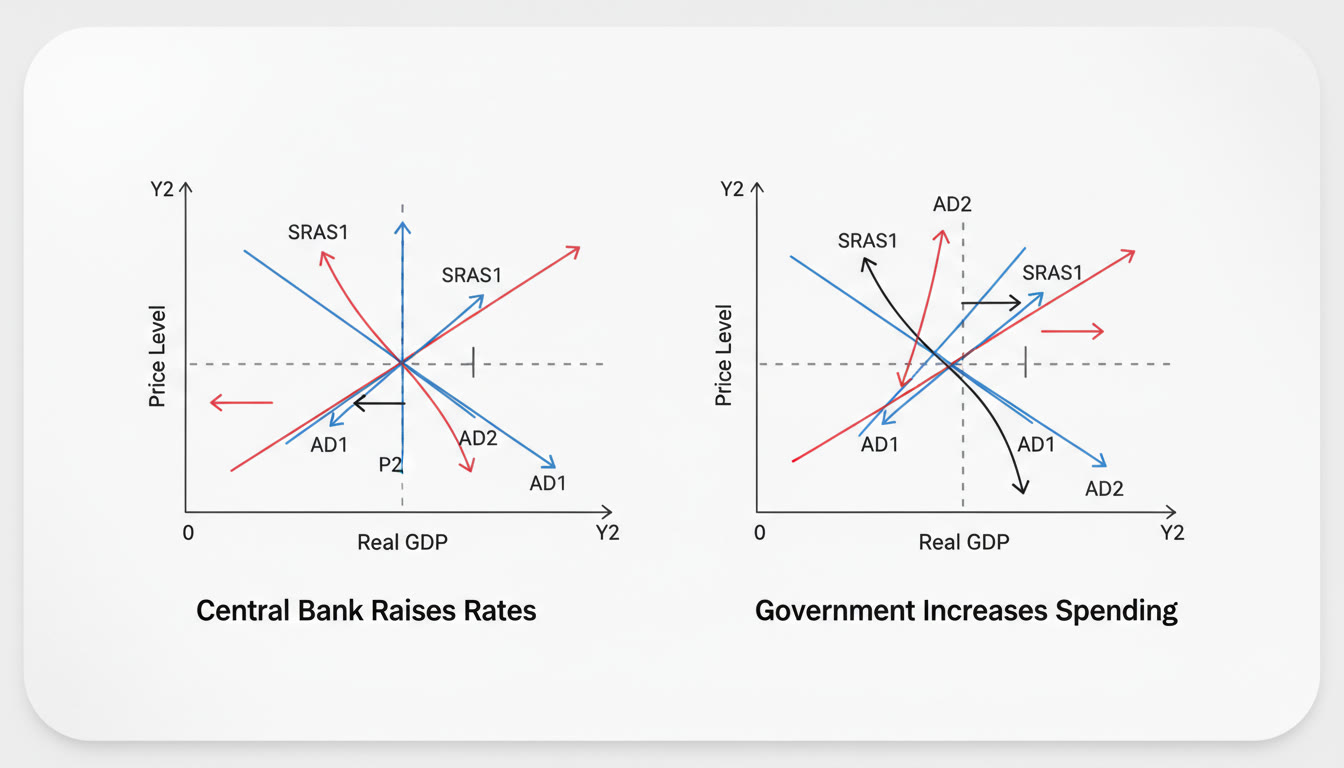

Example: Monetary Policy in Action

Imagine inflation climbs to 6% while unemployment is low. The central bank tightens policy by raising its policy rate. Banks increase lending rates, borrowing falls, consumption and investment slow, AD shifts left, and inflation eases. On a diagram, you’ll show a leftward shift of AD and comment on the short-run trade-off with output.

Fiscal Policy: Government Choices and Distributional Stories

Fiscal policy is the government’s response to economic gaps through spending and taxes. Where monetary policy uses interest rates and liquidity, fiscal policy changes the composition and level of AD directly. The narrative here is about priorities: stimulating growth, redistributing income, or stabilizing demand.

Key Fiscal Instruments and How to Explain Them

- Government Spending: Directly raises AD. Public investment (infrastructure, education) can also raise long-run productive capacity.

- Taxation: Cuts increase disposable income and AD; increases have the opposite effect. Mention incidence and who bears the burden.

- Transfer Payments: Targeted transfers support low-income households, increasing consumption and addressing equity concerns.

AP Macro questions often ask about the spending multiplier. Keep the narrative practical: “A fiscal expansion of $1 billion raises aggregate demand by more than $1 billion because recipients re-spend part of the income—how much more depends on the marginal propensity to consume (MPC).” That connects the math to the story.

Example: A Recession Response

During a demand-driven recession, a government might increase spending on infrastructure and cut payroll taxes. The immediate effect is a rightward shift in AD. You should explain the multiplier effect and note timing: fiscal policy can be powerful but may face delays (legislative and implementation lags), whereas monetary policy can be quicker.

Monetary vs Fiscal: How to Craft a Balanced Comparison

When an AP question asks you to compare, structure your answer. Use a short table or bullet list to show differences in speed, directness, effectiveness during liquidity traps, and distributional consequences. Below is a compact way to present that in an exam or study guide.

| Dimension | Monetary Policy | Fiscal Policy |

|---|---|---|

| Speed of Implementation | Usually faster (central bank decisions). | Slower (requires legislation and spending mechanisms). |

| Directness | Indirect—works through interest rates and expectations. | Direct—government can directly buy goods or transfer income. |

| Effectiveness in Liquidity Trap | Limited—lowering rates has little effect if rates are near zero. | Effective—direct spending can boost demand even when rates are low. |

| Distributional Impact | May affect savers vs borrowers differently. | Can be targeted for equity (transfers, progressive taxes). |

Exam-Ready Strategies: How To Write Crisp AP Answers

AP graders reward clarity, correct diagrams, and causal chains. Use this checklist when you practice:

- Start with a one-sentence thesis that answers the question directly.

- Draw and label diagrams (AD-AS, loanable funds, or market graphs) and explain shifts in words.

- Link policy instruments to outcomes with causal arrows: instrument → interest rates/AD → output/inflation/unemployment.

- Discuss short-run vs long-run effects and the role of expectations.

- If relevant, mention time lags and political or institutional constraints.

Short Example Answer Skeleton

Question: What happens to output and inflation when the central bank cuts its policy rate by 1%?

- Thesis: A 1% cut lowers market interest rates, raises investment and consumption, shifts AD right, and raises output and inflation in the short run.

- Diagram: AD shifts right—label new equilibrium with higher price level and output.

- Mechanism: Lower rates reduce borrowing costs, raise investment, and increase consumption via cheaper loans.

- Limits: If the economy is at full capacity, inflation rises more than output; in a liquidity trap effects may be muted.

Study Plan: From CBSE Revision to AP Readiness (8-Week Track)

This pragmatic 8-week plan helps you convert CBSE knowledge into AP exam skills. Tweak the pacing based on your strengths and school commitments.

| Weeks | Focus | Goals |

|---|---|---|

| 1–2 | Core Micro: Supply/Demand, Elasticity, Costs | Master graphs, consumer/producer surplus, and elasticity calculations. |

| 3–4 | Core Macro: GDP, Unemployment, Inflation | Understand measurement, short-run vs long-run, and Phillips curve basics. |

| 5 | Monetary Policy | Practice AD-AS, money supply, and central bank tools with examples. |

| 6 | Fiscal Policy | Work through multipliers, budget deficits, and policy timing. |

| 7 | Integrated Practice | Mixed questions, compare policies, and time-limited FRQ practice. |

| 8 | Mock Exams and Review | Full practice test, review errors, and refine exam strategy. |

Within each week, aim for 4–6 focused study sessions (45–75 minutes each). Alternate theory, problem sets, and timed free-response practice. Use CBSE notes to reinforce foundational concepts, but practice expressing them in AP-style language and diagrams.

Practice Tips: Make Learning Stick

- Explain concepts aloud to a peer or parent—teaching is a powerful test of understanding.

- Create a “one-page policy” cheat sheet: instruments, expected effects, and ideal scenarios for each tool.

- Use past AP free-response questions to practice causal chains and diagrams under time pressure.

- Alternate short memorization bursts (definitions, formulas) with long-form synthesis (writing full answers).

- Practice mental transitions: when you see a CBSE topic, ask, “How would AP test this?” and try to write a short AP-style answer.

How Personalized Tutoring Can Help — In a Natural Way

Many students find that targeted guidance shortens the learning curve. Personalized tutoring, such as Sparkl’s 1-on-1 tutoring, can help tailor the study plan above to your strengths and weaknesses. A tutor can:

- Create a tailored study schedule and adjust pacing based on progress.

- Walk through diagram practice and give immediate feedback on FRQ structure.

- Offer AI-driven insights and practice suggestions to focus on areas that yield the biggest score improvements.

Used sparingly and strategically, personalized support supplements your independent study and helps you translate classroom knowledge into AP-ready performance.

Common Pitfalls and How to Avoid Them

- Over-Reliance on Memorization: AP rewards applied understanding. Always link definitions to causal stories and diagrams.

- Weak Diagram Skills: Practice labeling axes, curves, and shifts. Explain each movement in one sentence.

- Ignoring Long-Run vs Short-Run Dynamics: Be explicit when effects differ across time horizons.

- Poor Time Management in FRQs: Practice timed responses and learn a lean outline to start each answer.

Real-World Context: Telling Contemporary Stories

One important skill in AP essays is grounding abstract policy in real-world narratives. For example:

- When inflation spikes after supply chain disruptions, explain how supply-side factors complicate standard monetary responses.

- When a government uses targeted transfers to support households during a downturn, discuss both the immediate AD effects and long-run implications for fiscal sustainability.

- When interest rates rise globally, discuss capital flows, exchange rates, and implications for small open economies.

These contextual additions show depth—your examiner gets a sense that you can not only manipulate graphs but also appreciate policy nuance.

Putting It All Together: A Model Answer Example

Question: “Explain how a central bank’s decision to raise its policy rate interacts with a government’s decision to increase infrastructure spending. Discuss short-run and long-run effects on output and price level.”

Model approach:

- Thesis: The central bank’s rate hike tends to reduce AD, while increased government infrastructure spending raises AD; the net short-run effect depends on the relative magnitudes and timing of the two policies.

- Short-run: Show AD shift left from rate hike, AD shift right from fiscal expansion. If the fiscal expansion is larger or quicker, AD may rise overall, boosting output and the price level. If monetary tightening dominates, AD will fall, reducing inflation but lowering output.

- Long-run: Infrastructure spending can raise aggregate supply (AS) if it increases productive capacity—shifting LRAS right and raising potential output. Monetary policy affects inflation expectations; a persistent tight policy can reduce inflation but may not change long-run potential.

- Conclusion: The interaction depends on timing, magnitude, and whether fiscal measures improve long-run supply. Mention potential crowding-out if monetary tightening significantly raises borrowing costs.

Final Thoughts: Confidence, Clarity, and Curiosity

Moving from CBSE Economics to AP Macro and Micro is less about relearning and more about deepening and communicating. Keep the story-based approach you already use—then sharpen it with AP-style diagrams, causal chains, and time-bound reasoning. Practice writing concise, well-labeled answers under timed conditions and seek feedback where possible. Personalized tutoring (for example, Sparkl’s tailored plans and expert tutors) can be helpful when you want focused feedback on diagrams, FRQ structure, and pacing.

Above all, stay curious. Economics is a way of telling stories about choices and trade-offs. The more you practice turning graphs and formulas into human narratives—about families, firms, and governments—the more naturally the AP exam will feel.

Quick Checklist Before Your Next Practice Session

- Draw and label at least three AD-AS or market diagrams.

- Write one timed FRQ answer using the thesis-diagram-mechanism-limit structure.

- Review the week’s mistakes and convert them into one-sentence rules to avoid repeating them.

- Consider one 1-on-1 session if you need targeted feedback on writing or diagrams.

Good luck—bring your CBSE clarity, layer on AP precision, and tell policy stories that are both technically correct and meaningfully human. You’ve got this.

No Comments

Leave a comment Cancel