Introduction: Why planning for SAT and application costs matters (and why you’re not alone)

Take a breath. If you’re a parent reading this, you’re probably juggling a thousand little things — schedules, deadlines, emotional pep talks, and the inevitable question of how to pay for it all. The Digital SAT and college applications are a big ticket on the path to higher education, but with a little structure and some up-to-date knowledge, you can avoid surprise fees, make strategic choices, and support your student without burning out your budget.

This guide takes you step-by-step through what to expect, how to qualify for fee waivers, ways to save on test prep and score sends, and how to build a balanced, realistic plan that includes test prep investments (such as Sparkl’s personalized tutoring) when they make sense. It’s practical, empathetic, and written for busy families who want clarity and confidence.

Understand the cost landscape: What are the common expenses?

The costs connected to the SAT and college applications fall into a few predictable buckets. Knowing them is half the battle — once you know what to expect, you can make smart trade-offs.

- SAT registration fees — The basic fee to sit for the Digital SAT on a weekend test date. (If your student qualifies for a fee waiver, this fee may be covered.)

- Score sends — Sending scores to colleges; often some free score sends are included when you register, but additional sends or late sends usually cost a modest fee.

- Test preparation — Options range from free resources and group courses to one-on-one tutoring. Costs vary widely; personalized tutoring typically costs more but can be more efficient.

- College application fees — Each application usually has its own fee, though fee waivers and some no-fee schools reduce the burden.

- Other fees — Standby fees, late registration fees (if applicable), verification fees, or sending score verification/reports.

Quick comparison — what you might pay (typical ranges)

| Item | Typical cost (low) | Typical cost (high) | Notes |

|---|---|---|---|

| SAT registration (weekend) | Covered by fee waiver | Varies (check current College Board pricing) | Many students pay the basic registration fee unless eligible for a waiver. |

| Score sends (after free allotment) | $0 (within free sends) | Approximately $14–$31 per send (rush/after deadline) | Free sends typically included when registering; changes after deadline may cost more. |

| College application fee | $0 (fee waiver) | $90–$100+ per application | Many selective schools have high fees; plan application list strategically. |

| 1-on-1 personalized tutoring | Free trials or modest hourly rates | Higher hourly rates for experienced tutors or programs | Personalized tutoring (like Sparkl’s offerings) can speed progress and reduce overall prep time. |

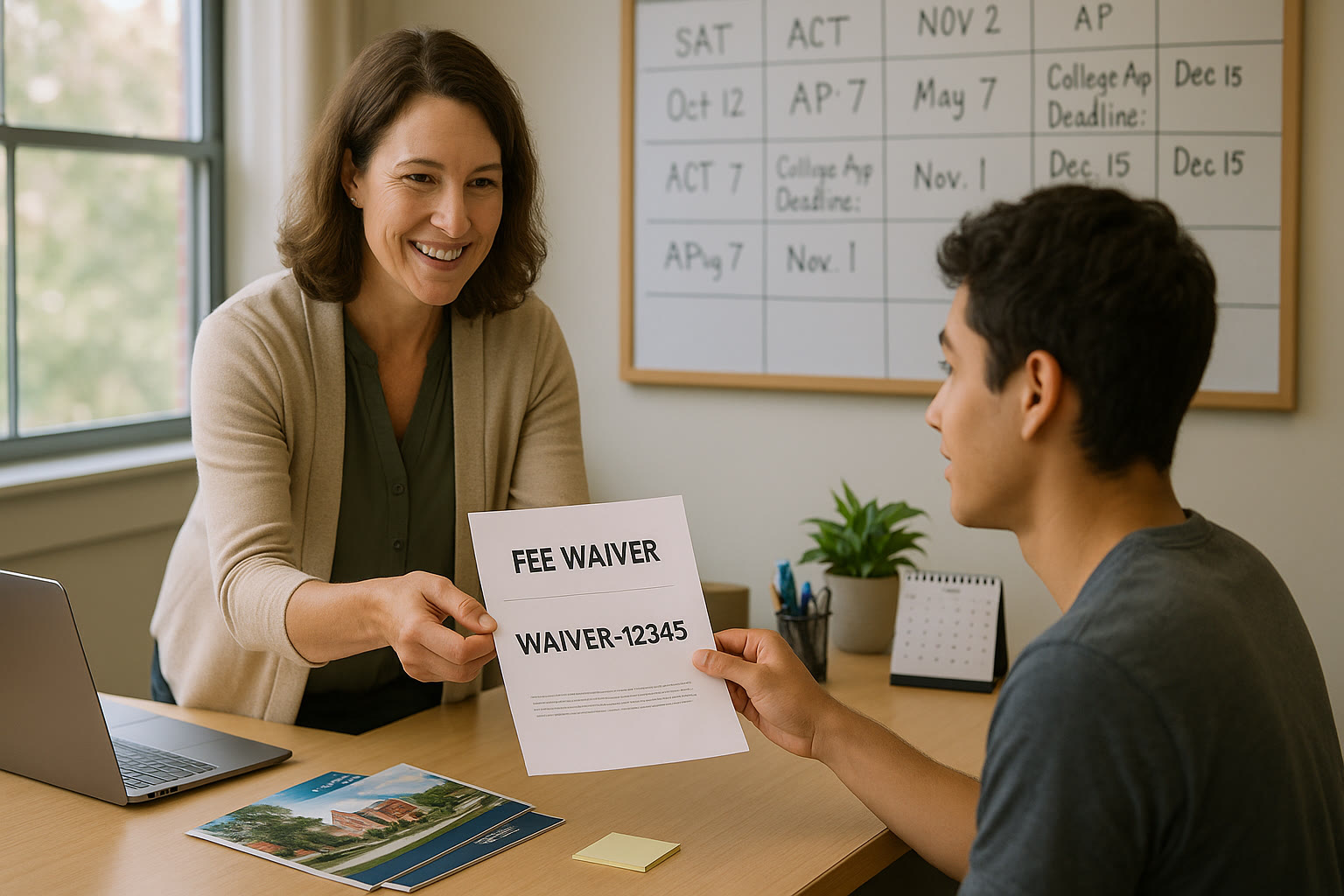

Fee waivers: The most powerful tool in your cost-reduction toolbox

Fee waivers are designed to remove financial barriers for eligible students. If your family qualifies, they cover not just SAT registration but also many application-related fees — a game-changer for families on tight budgets.

Who is typically eligible?

- Students already enrolled in programs like the National School Lunch Program.

- Families with incomes that meet federal guidelines.

- Students in foster care, living in subsidized housing, unhoused, or wards of the state.

- Students participating in specific federal or local programs (for example, TRIO).

If any of those descriptions fit your household, talk to your school counselor or follow the fee waiver request options — either through your counselor or by a direct request process. If you’re a homeschooling family or testing internationally, there are paths to request waivers directly as well.

What fee waivers typically cover

- Free SAT test registrations (e.g., two free tests for many eligible students).

- Unlimited free score reports to colleges for students with waivers.

- College application fee waivers for qualifying students on specific application platforms.

- Waived late registration or cancellation fees in many cases.

Action step: If you think your student might qualify, contact the school counselor now. If that’s not possible, look into the self-identification request process and gather basic documentation so you can apply early — ideally at least 1–2 weeks before registration deadlines.

Timing is everything: When to register, when to send scores, when to apply

Costs change depending on timing. Strategic scheduling can eliminate or reduce fees — and reduce stress.

Smart timing tips

- Register early for a weekend SAT date to secure included score sends and avoid last-minute charges.

- Designate free score recipients when you register or in the first days following the test; making that choice promptly often avoids fees.

- Use fee waivers to send as many scores as you need — unlimited sends are a feature for eligible students.

- Plan your application list so you’re not surprised by numerous $75–$90 fees within the same week. Stagger applications across months if possible.

Practical timeline example (junior to senior year)

Here’s a simple timeline to keep things in scope.

- Junior year spring: Have your student take a full practice Digital SAT to identify strengths and gaps.

- Summer before senior year: Begin focused prep; if using paid tutoring, start early to allow measurable improvement.

- Early senior year (August–October): Take or retake the SAT if needed. Use free score sends strategically.

- Fall senior year (September–December): Submit applications in waves rather than all at once to manage application fees.

How to choose cost-effective test prep: self-study vs group classes vs 1-on-1 tutoring

Investing in test prep is an investment in time as much as money. The right choice depends on your student’s needs, learning style, and your family budget.

Options and considerations

- Free or low-cost resources: Official practice tests, practice apps, school-based programs, and online practice materials. Great for disciplined students who can self-motivate.

- Group courses: Structured with a teacher and classmates; more affordable than private tutoring and good for routine and accountability.

- 1-on-1 personalized tutoring: Tailored to the student’s unique gaps and pacing. While pricier hourly, it can be more efficient and often produces faster, targeted score improvements. If your student benefits from individualized attention, this can be the most cost-effective path in the long run. Personalized offerings, such as Sparkl’s tutoring, combine tailored study plans, expert tutors, and AI-driven insights to focus study where it matters most.

How to evaluate a tutoring investment

- Ask for a diagnostic: A good tutor or program will start by measuring a student’s baseline strengths and weaknesses.

- Look for a clear study plan: What will be covered, on what timeline, and how will progress be measured?

- Check for trial sessions or short-term commitments: These reduce the risk of paying for an unsuitable program.

- Consider ROI: Would a moderate number of targeted tutoring sessions save you time and avoid the need for additional test attempts and score sends?

Budgeting worksheet: a simple way to project total costs

Below is a compact budgeting approach you can use to estimate your family’s out-of-pocket expenses. Replace the sample numbers with your expected costs.

| Category | Estimated units | Estimated cost per unit | Projected subtotal |

|---|---|---|---|

| SAT registrations | 2 | $0–(standard fee) | Varies (check waiver eligibility) |

| Extra score sends | 3 | $14 | $42 |

| College application fees | 6 | $75 | $450 |

| 1-on-1 tutoring (e.g., 20 hours) | 20 | Varies (per-hour) | Varies (estimate) |

| Test prep materials / practice tests | 1 | $0–$30 | $0–$30 |

Action step: Create your own version of this table in a spreadsheet. Update it as you confirm fees (registration, tutoring rates, and expected number of applications) so the projected subtotal will give you an accurate picture of likely spending.

Cost-saving strategies that actually work

Beyond fee waivers and careful timing, here are practical strategies families use to reduce costs without sacrificing outcomes.

Consolidate and prioritize

- Focus on a balanced college list: Reach, target, and safety schools — avoid applying to dozens of high-fee reach schools unless each one is a serious option.

- Use free score sends wisely: Choose your core colleges at registration to capture included sends.

Leverage school resources

- Public high schools often offer free or low-cost prep programs, practice sessions, and sometimes Saturday classes.

- School counselors can provide fee waiver codes and may know about local scholarships for application assistance.

Targeted tutoring beats hours of generic practice

Rather than long, unfocused hours, targeted tutoring addresses key weak areas and test strategies. Personalized approaches — for instance, an initial diagnostic followed by a clear plan and short-term checkpoints — are often more efficient. If you choose to invest in 1-on-1 help, consider programs that combine expert tutors with data-driven planning; these typically get the most progress out of fewer hours.

When fee waivers don’t apply: low-cost alternatives and financial supports

If your family doesn’t qualify for fee waivers, there are still ways to reduce costs:

- Use school or community resources for free practice tests and workshops.

- Ask about sliding-scale tutoring or group coaching options at community centers or libraries.

- Look for scholarship programs, local nonprofits, or college-access organizations that provide test prep or application fee assistance.

Why investing in targeted tutoring can save money long-term

It might feel counterintuitive to spend on tutoring when your goal is to cut costs. But consider this: a well-designed, personalized plan can boost scores faster, reduce the number of test attempts, and lower the number of extra score sends and application cycles. For many families, a short, sharp investment in targeted tutoring is less expensive than repeating tests or applying to more schools due to uncertain scores.

If you decide to invest, look for these qualities: expert tutors who specialize in the Digital SAT format, measurable progress reporting, and an individualized study plan. Services that combine human tutors with data-driven insights (like personalized scheduling or AI-informed practice recommendations) often give better outcomes for the time and money spent. Sparkl’s personalized tutoring, for instance, emphasizes tailored study plans, one-on-one guidance, and AI-driven insights to pinpoint the highest-impact areas — useful when every hour counts.

Practical checklist for parents: take action this month

- Talk to your child’s school counselor about eligibility for fee waivers and request a code if eligible.

- Set up a simple budget spreadsheet with projected registration, score send, and application fees.

- Decide early whether you’ll invest in group classes, self-study, or 1-on-1 tutoring, and request diagnostic assessments before purchasing long-term packages.

- Plan your student’s testing and application timeline and enter deadlines into a shared family calendar.

- Have a backup plan: if tests or applications cost more than expected, identify one category where you can cut back or postpone (extra score sends, extra test attempts, or number of applications).

Real-world examples: families who planned well (and what they learned)

Example 1 — The staggered-applications family: By spreading six applications across three months, this family avoided processing a cluster of $90 payments in one billing cycle and used one round of targeted tutoring that produced enough score improvement to remove the need for a costly second test day.

Example 2 — The fee waiver family: A student who qualified for fee waivers used free score sends to apply to eight colleges without paying application fees. They saved a significant portion of their budget and allocated a small amount toward a few hours of targeted tutoring to strengthen the application essay — an investment that paid off in admissions confidence and a scholarship offer.

Balancing finances and emotional support: what parents can do beyond the budget

Money matters, but so do morale and stress levels. College admissions are an emotional marathon. Your calm presence, realistic expectations, and steady support are as valuable as any dollar figure. Celebrate small wins, keep perspective, and help your student learn that the process is a journey — not a single test or a single application.

- Schedule short, regular check-ins rather than firefighting sessions right before deadlines.

- Encourage healthy routines: sleep, exercise, and balanced study blocks produce better results than frantic cramming.

- Normalize adjustments: budgets and plans may change, and that’s okay. Flexibility reduces panic.

Bottom line: plan early, use waivers, and invest smartly in what moves the needle

Parents who start early, explore fee waivers, and make strategic investments in targeted tutoring and scheduling tend to pay less overall and feel more in control. The right mix of free resources, school-provided supports, and a few targeted paid hours of personalized tutoring (when appropriate) is a balanced approach that respects both your family’s finances and your student’s potential.

Think of it as an efficiency problem: how to maximize outcomes (scores, fit, and financial aid opportunities) for the least total cost. With fee waivers, careful timing, and focused prep, you can make decisive gains without undue expense — and you’ll be helping your student move to the next chapter with confidence.

Final practical resources (your next steps)

- Contact your school counselor about fee waiver eligibility and request codes early.

- Create a budget spreadsheet and timeline with the family.

- Request a diagnostic test before buying any large test-prep package.

- Consider short, targeted tutoring blocks to build skills efficiently. If you want a personalized tutoring option that focuses on tailored study plans, 1-on-1 guidance, and AI-driven insights, explore programs that offer trial sessions to measure fit and results — these can save money over time by reducing the number of test attempts.

- Plan application waves to spread costs and reduce financial shock in any single month.

A final note to parents

This process tests more than academic readiness — it tests planning, patience, and the ability to stay calm under pressure. By breaking the process down into predictable parts, using fee waivers where available, and making smart choices about prep investments, you’ll protect both your family’s finances and your student’s mental space. And remember: the college journey is broad and full of options; this test and these fees are an important piece, but they aren’t the whole story.

If you want help building a tailored plan that fits your family’s finances and your student’s learning style — including deciding whether short-term personalized tutoring could be the high-impact, cost-saving approach you need — set aside time to compare diagnostic results and short trials before committing to long programs. A measured, data-informed choice often turns out to be the most economical and effective path forward.

Here’s to calm planning, strategic decisions, and a confident senior year.

No Comments

Leave a comment Cancel