Why this guide matters: connecting SAT scores to real dollars and choices

As a parent, you’re juggling a thousand small fires: deadlines, transcripts, campus visits, and the inevitable question — will we be able to afford college? The Digital SAT (the College Board’s updated SAT format) still plays a role for many families not only in admissions but in unlocking scholarships and merit aid. This guide walks you, step-by-step, through how SAT scores interact with financial aid, what to focus on, and practical strategies you can use right now to improve your child’s chances of getting more aid — not just admission.

Top-line truths every parent should know

Before we dive into tactics, here are the essential facts in plain English.

- SAT scores can affect merit scholarships. Many colleges award scholarships based on objective criteria like test scores and GPA.

- Need-based aid (like FAFSA/College’s institutional need-based grants) is driven primarily by family financial information, not test scores.

- Some schools are test-optional or test-blind; however, scores may still be used for scholarships, placement, or to strengthen an application if they’re strong.

- Score reporting rules vary. Some schools accept Score Choice (send your best test date), others require all scores. Know the policies for each school.

- Timely planning multiplies options: early outreach, applying to scholarship programs, and joining College Board services (like Student Search Service) expand opportunities.

How colleges typically use SAT scores (and where money comes in)

Understanding the distinction between admissions decisions and scholarships helps you prioritize. Think of SAT scores as useful in three main ways:

1) Admissions influence

At test-optional schools, a strong SAT score can tip a close decision toward admit; at test-required schools, it’s part of the academic snapshot. For borderline candidates, a higher SAT can mean admission to a more selective program — and with it, potentially different financial offers.

2) Merit-based scholarships (the high-impact area)

Many institutions use SAT scores as objective thresholds for automatic or competitive merit awards. A few examples of how this works:

- Automatic scholarships: Some schools guarantee a set scholarship amount to applicants above a certain SAT range.

- Competitive merit awards: Higher scores increase a student’s chance in subjective selection pools.

- Departmental scholarships and honors programs: These often use test scores for initial screening.

3) Course placement and support services

Although not direct money, SAT scores can influence placement into courses that affect time-to-degree and costs (e.g., avoiding remedial classes that add credits and tuition). Better placement can reduce long-term costs and boost academic success.

Mapping SAT score bands to likely scholarship outcomes

Every college is different, but broadly, you can think of SAT ranges as opening different tiers of opportunity. Use this as a planning tool, not an iron rule.

| SAT Range (Evidence-Based Reading & Writing + Math) | Typical Scholarship/Admission Impact | Parent Actions |

|---|---|---|

| Below 1000 | Limited merit scholarship eligibility at selective schools; may be test-optional candidates | Evaluate test prep options; focus on strengthening GPA, AP/IB, and extracurriculars; apply widely; consider community college pathways |

| 1000–1200 | Good chance for regional merit awards and many private scholarships | Target test prep to gain +50–100 points; apply to schools with automatic merit schedules; research scholarship deadlines |

| 1200–1400 | Competitive for strong merit awards, honors programs at many schools | Fine-tune weaknesses; practice under digital test conditions; use Score Choice strategically |

| 1400+ | High likelihood of top-tier merit scholarships at many institutions | Polish application essays and extracurriculars to secure competitive scholarships; explore full-tuition merit possibilities |

Seven practical steps parents can take right now

Ready for the checklist? These steps move you from uncertainty to control.

1. Make a college+financial map

Build a spreadsheet with the colleges your student is considering and add columns for: admission policy (test-optional/test-required), SAT score ranges (25th–75th percentile), known merit scholarship thresholds, cost of attendance, and important deadlines. This map turns vague hopes into measurable targets.

2. Understand each school’s score-reporting rules

Some schools want all SAT dates; others allow Score Choice. This dictates whether your child should rush to retake tests or focus on perfecting a single strong date. Check each school’s policy at the time of application and make decisions accordingly.

3. Use the Student Search Service and BigFuture options

Opting into Student Search Service and using BigFuture increases the family’s visibility to colleges and scholarship programs that match the student’s profile. It’s an easy, low-effort way to surface targeted scholarship opportunities that might otherwise be missed.

4. Time the FAFSA and CSS Profile strategically

Need-based aid is driven by FAFSA (and sometimes CSS Profile) data. Make sure you know the exact FAFSA opening date for the student’s application year and gather tax documents early. Missing early deadlines can cost thousands in institutional aid opportunities.

5. Treat the SAT as a tool, not a threat

For many students, small, targeted score improvements (30–100 points) can change scholarship eligibility. Focused practice on weaker areas or on digital test navigation yields outsized returns compared to generalized studying.

6. Consider cost-effective retake strategies

Because the Digital SAT emphasizes fewer but more strategic questions and adapts pacing, schedule at least one practice administration under test-like conditions. If scores improve, use Score Choice appropriately when sending results.

7. Prepare a scholarship application calendar

Create a calendar with deadlines for institutional scholarships, outside scholarships, and major prize competitions. Many scholarships are awarded on rolling or early-deadline bases; earlier is often better.

How to prioritize test prep to maximize financial returns

With limited time and money, focus on the strategies with the largest expected return on investment.

- Identify target schools and their scholarship brackets — it tells you how many points you need to chase.

- Use diagnostic tests to pinpoint the largest weaknesses and prioritize them.

- Practice in the Digital SAT environment — timing, tools, and question types matter.

- Mix targeted tutoring and self-study. One-on-one tutoring often accelerates gains because it’s tailored; services like Sparkl’s personalized tutoring can provide 1-on-1 guidance, tailored study plans, and AI-driven insights to focus effort efficiently.

Examples: small score gains, big financial wins

Concrete examples help. Here are two anonymized, realistic scenarios parents may recognize.

Case A: From good to scholarship-ready

Student A scored 1220 and is considering three state universities where automatic merit scholarships kick in at 1300. With eight weeks of targeted prep focused on math pacing and evidence-based reading strategies, Student A boosts to 1310 on a retake and becomes eligible for a renewable $6,000/year scholarship at one school. Over four years, that’s $24,000 saved for a relatively small time investment.

Case B: Strategic Score Choice and reach schools

Student B scores 1380 on one test and 1450 on another. A few reach schools require all scores, but several selective private colleges consider only the best. By using Score Choice where allowed, and sending all scores where required, Student B positions themselves for merit consideration at institutions that award scholarships at the 1400+ level — turning a strong score into significant scholarship leverage.

What about test-optional schools? Don’t assume “optional” means “irrelevant”

Test-optional policies vary. For some colleges, “optional” means your application is read holistically and strong scores can still unlock scholarships or honors consideration. For others, they’ll ignore scores entirely. Before deciding to skip sending a score, ask yourself:

- Does the school use scores for scholarship eligibility?

- Will a score strengthen a specific part of the application (e.g., when GPA is lower than school averages)?

- Are there automatic merit awards tied to score bands that you could qualify for?

If the answer to any of these is yes, consider sending scores.

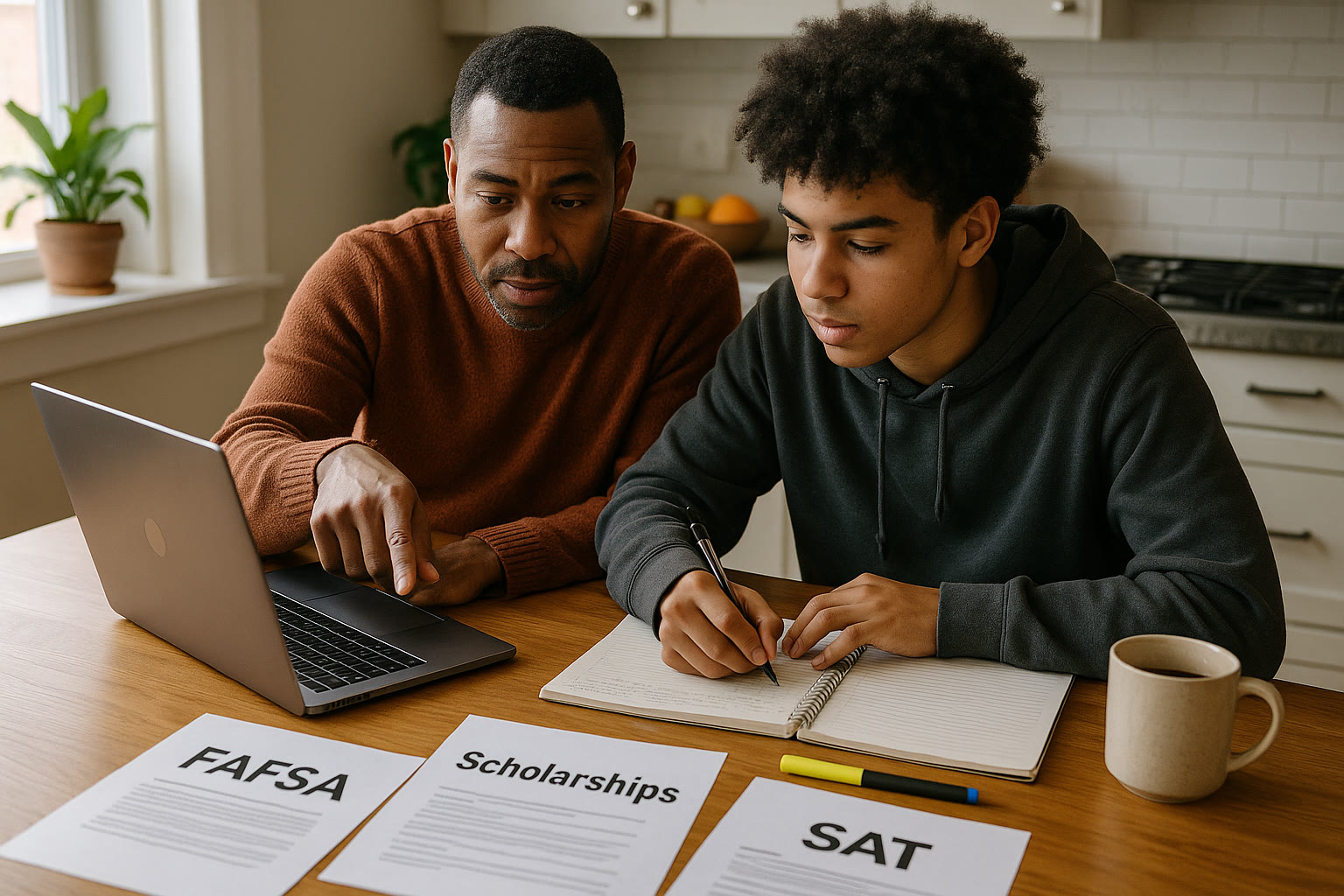

How parents can help without taking over

Your support is critical — but teens need ownership. Here’s a balanced approach:

- Lead coordination: organize deadlines, financial documents, and the college map spreadsheet.

- Provide structure: schedule test dates and quiet study windows, and help obtain reputable prep resources or tutors.

- Offer emotional support: normalize retakes, celebrate practice improvements, and avoid letting test scores become the only measure of worth.

- Invest wisely: targeted tutoring or expert guidance — for example, Sparkl’s one-on-one approach with tailored study plans and expert feedback — can be worth the cost when the likely scholarship return is high.

Reading and interpreting score reports like a pro

A typical SAT report shows section scores, subscores, and question-type strengths/weaknesses. Parents and students should:

- Look at evidence-based reading & writing and math separately to set focused goals.

- Use subscores to design study blocks (e.g., if sentence structure is weak, focus on grammar drills).

- Track progress across practice tests, not just official tests — consistent improvement indicates readiness to retake.

How to handle special situations

If income is the primary barrier

Need-based aid from federal and institutional sources is determined by FAFSA/CSS Profile data. Even if SAT scores don’t directly change need-based aid, reducing the overall cost through merit scholarships makes college more affordable. Apply for both need-based aid and merit scholarships; they’re not mutually exclusive.

If GPA lags but test scores are strong

A strong SAT may offset a GPA in admissions or scholarship considerations at some schools. Use the scores to demonstrate academic readiness and pair them with strong essays and teacher recommendations that explain improvement or context.

If the student is late to prep

It’s never too late to make meaningful gains. Short, focused campaigns — diagnostic test, three-week targeted study, then an official retake — can be transformational. Prioritize the highest-impact errors and simulate test conditions.

Negotiating financial aid: when SATs matter in appeals

If an admission offer is attractive but the financial package falls short, you can appeal. While financial appeals rely on new financial information, sometimes presenting additional academic merits — like a stronger test score or new scholarship wins — can strengthen your case. Include updated test scores, improved grades, and new awards in the appeal packet if they change the student’s demonstrated merit.

Tools, timelines, and a sample timeline

Below is a compact sample timeline for a rising senior who wants to maximize scholarship opportunities while balancing application work.

| Month | Action | Why it matters |

|---|---|---|

| January–June (Junior year) | Diagnostic SAT, targeted prep begins, build college list | Identify score gaps and scholarship thresholds early |

| July–September (Summer/Fall) | Practice Digital SAT, take official test in late summer or fall | Gives time for retakes and strengthens application before early deadlines |

| October–December | Retake SAT if needed, finalize college list, gather financial documents | Better scores can influence early-decision/early-action scholarships |

| January–March (Senior year) | Submit FAFSA/CSS Profile as soon as available, apply for scholarships | Early submission maximizes consideration for institutional funds |

When to consider professional help — and what to expect

Consider investing in professional tutoring if:

- Your child needs a 50+ point gain to reach a scholarship threshold.

- Content gaps (e.g., algebra skills) are holding the score down.

- You want efficient study plans tailored to the Digital SAT format.

Professional tutors should provide diagnostics, a personalized plan, measurable milestones, and regular reporting. Programs that combine human tutors with AI-driven practice can accelerate progress while keeping costs manageable. If you’re evaluating options, look for evidence of past student improvements, transparent pricing, and the flexibility to adapt to a student’s schedule. Sparkl’s personalized approach — combining 1-on-1 guidance, tailored study plans, and AI-driven insights — is an example of how coaching can be tailored to both a student’s academic needs and scholarship targets.

Checklist to take away: concrete things to do this week

- Create your college + financial map spreadsheet with test policies and scholarship thresholds.

- Have your student take a full-length Digital SAT practice test under timed conditions.

- Opt into Student Search Service and sign up for the BigFuture resources if you haven’t already.

- Set one realistic weekly study block and consider a short diagnostic tutoring session to prioritize effort.

- Gather tax documents and calendar FAFSA/CSS Profile opening dates for the application year.

Final thoughts: strategy beats panic

College planning and paying for it can feel overwhelming — but a calm, strategic approach turns uncertainty into options. SAT scores are one lever among many. When aligned with targeted prep, strategic score reporting, and timely financial applications, they can unlock substantial scholarship dollars. As parents, your most effective role is organizer, encourager, and strategic advisor: build the plan, focus the work, and support without controlling.

If you’d like, you can start by mapping three colleges your student loves, identifying their SAT scholarship thresholds, and planning one targeted study cycle. Small, consistent progress compounds into real financial advantage.

Resources to keep in mind

Make the Student Search Service and BigFuture tools part of your toolkit early. Use official score reports and practice tests to measure progress. If you choose professional help, look for tailored programs that focus on both skill gaps and scholarship strategy — blending expert tutors with adaptive practice is often the sweet spot.

A hopeful closing

Families who plan early, focus efforts where they’ll move the needle, and leverage targeted support often find more than they expected: not just better scores, but more options, less stress, and real college affordability. You don’t have to navigate this alone — thoughtful, tailored help can keep your child motivated and your family’s costs down. Take the first step this week: map, practice, and plan.

Wishing you clarity and momentum on this important journey.

No Comments

Leave a comment Cancel