Introduction: Why SATs and Need-Based Aid Still Matter

Let’s start with a comforting truth: families don’t need perfect SAT scores to unlock meaningful need-based financial aid. But understanding how colleges look at test scores, how need-based aid is calculated, and what role the SAT plays in scholarships and admissions will help you and your student make smarter choices — from the way you prepare for the Digital SAT to the way you assemble FAFSA and CSS Profile materials.

What Is Need-Based Aid (Quick Overview)

Need-based aid is financial assistance awarded because a family cannot reasonably pay the full cost of a college education. It comes in different forms — grants (which don’t need to be repaid), subsidized loans, work-study, and sometimes institutional scholarships that consider financial circumstances. The two primary components to understand are the family’s financial picture (reported through FAFSA and, when required, the CSS Profile) and the college’s determination of the student’s demonstrated financial need.

Key documents that drive need-based aid

- FAFSA (Free Application for Federal Student Aid): Required for federal aid and most institutional aid.

- CSS Profile: Required by many private colleges to dig deeper into family finances.

- College-specific forms or verification documents (tax returns, W-2s) when requested.

Does the SAT Affect Need-Based Aid?

Short answer: Not directly. Need-based aid is primarily calculated from financial data. However, SAT scores can influence merit scholarships and admissions decisions — which can change the net cost of attendance. Here’s how to think about the interplay.

How the relationship works in practice

- Need-based aid formula: Colleges largely base need on income, assets, family size, and student status. SAT scores aren’t part of the arithmetic used by FAFSA or CSS Profile.

- Merit scholarships: Many colleges award scholarships based on academic performance or test scores. Strong SAT results can reduce out-of-pocket cost via merit awards.

- Admissions + aid packaging: For many selective institutions, being admitted is the first step before a financial aid package is assembled. Better test performance can improve admission chances — and thus the opportunity to receive institutional aid (both need- and merit-based).

Put simply: SATs don’t determine need, but they can affect the size and composition of the financial aid package you receive.

What Parents Should Watch During the Application Timeline

Timing matters. Financial aid timelines and testing seasons overlap with college applications, so map these out early.

High-level timeline

| When | What to do | Why it matters |

|---|---|---|

| Junior year spring–summer | Start SAT prep, build college list, create a College Board account and BigFuture profile. | Gives time for score improvement and helps estimate likely admissions/aid outcomes. |

| Senior year fall | Take/retake the Digital SAT if required, complete college applications, open FAFSA when it becomes available in October, and submit CSS Profile if required. | Early action/decision deadlines and institutional aid deadlines often fall here. |

| Senior year winter–spring | Review aid offers, respond to colleges, file any verification documents. | You’ll compare award letters to choose the best financial fit. |

Practical checklist for parents

- Mark FAFSA opening date on your calendar (typically October 1 each year) and file as early as possible.

- Identify which colleges require the CSS Profile and their deadlines.

- Encourage your student to take Official Digital SAT practice and at least one diagnostic test well before application season.

- Decide if your family will opt into College Board’s Student Search Service or BigFuture communications — these can surface scholarship opportunities.

How Colleges Use SAT Scores When They Also Offer Need-Based Aid

Colleges vary. Some are test-optional, some require tests, and some use scores as part of scholarship algorithms. When reading award letters, pay attention to two things: whether the aid is need-based (often labeled as grants or institutional need-based awards) or merit-based (scholarships based on achievement).

Examples of how scores can indirectly change aid

- A student with modest financial need and a high SAT might receive a larger merit scholarship, decreasing the family’s net price.

- At a test-optional school, a strong SAT score submitted by an applicant might move them from a borderline admit to a clear admit — unlocking an institutional need grant that only admitted students receive.

- Some colleges consider test scores for specific talent scholarships (STEM, writing, music) that are separate from need evaluations.

Understanding Award Letters: A Parent’s Translation Guide

Award letters can feel like a foreign language. Break them down piece by piece.

Key terms and what they mean

- Cost of Attendance (COA): Total annual cost — tuition, fees, room, board, books, and an estimate for personal expenses.

- Expected Family Contribution (EFC) / Student Aid Index (SAI): The number used to estimate what your family can pay. It’s calculated from FAFSA/CSS data.

- Need-Based Grant: Money based on demonstrated financial need — typically does not need to be repaid.

- Merit Scholarship: Award based on academic or other achievements — often tied to grades or test scores.

- Net Price: COA minus grants and scholarships — the real cost you’ll likely pay.

How to compare two packages

- Compare net price, not listed tuition.

- Prefer grant aid over loans — loans add future cost.

- Examine work-study and loan requirements separately from grants.

Sample Comparison Table: Two Hypothetical Award Letters

This table demonstrates why net price matters more than sticker price.

| Item | College A (Selective, high merit) | College B (Generous need-based grant) |

|---|---|---|

| Sticker Price (COA) | $78,000 | $55,000 |

| Need-Based Grant | $20,000 | $30,000 |

| Merit Scholarship | $25,000 | $5,000 |

| Loans | $5,500 | $5,500 |

| Net Price (COA – grants – merit) | $28,000 | $19,500 |

In this example, College B — despite a lower merit scholarship — is significantly cheaper after accounting for institutional need-based grants. That’s why parents should ask colleges for clear explanations of how awards are calculated.

Strategies to Maximize Aid (Without Risking Admissions)

There’s no magic trick, but there are smart moves families can make.

Financial and application strategies

- File FAFSA early and accurately — some aid is first-come, first-served.

- If a college requires the CSS Profile, gather documents early — it asks for more detailed financial data.

- Ask colleges to re-evaluate your aid if your financial situation changed after filing (job loss, medical bills) — many schools have an appeal process.

- Consider applying early to institutions where your student is a strong fit — some schools award more generous aid to early applicants, though policies vary.

Testing and scholarship strategies

- Use the Digital SAT to your advantage: the shorter, adaptive format rewards steady preparation and can reduce test fatigue.

- Practice with official digital practice tools and full-length diagnostics to identify weak areas. Targeted improvement can yield significant scholarship-related gains.

- Balance effort: if your student can realistically raise their SAT score meaningfully with a couple months of focused study, the potential increase in merit aid may be worth the investment.

Practical Study Plan for Busy Families

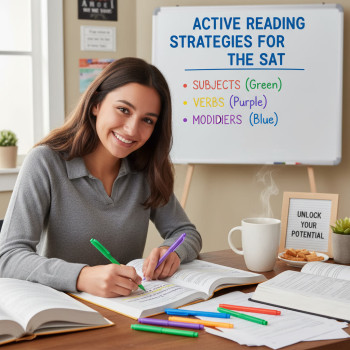

Here’s a simple 10-week study plan that keeps progress manageable and targeted, designed for students balancing school and activities.

- Weeks 1–2: Diagnostic test and goal setting. Identify 1–2 score bands with room for improvement.

- Weeks 3–6: Focused content blocks (two weeks per core area: reading, math, grammar). Daily practice: 30–60 minutes.

- Week 7: Full-length digital practice test under timed conditions. Review weaknesses.

- Week 8: Targeted drills on persistent weak points and strategy refinement.

- Week 9: Second full-length practice test; polish timing strategies for adaptive sections.

- Week 10: Light review, rest, and test-day logistics prep.

If you’re looking for 1-on-1 guidance, Sparkl’s personalized tutoring can fit into this kind of plan — tutors create tailored study plans, offer expert feedback, and use AI-driven insights to track progress so students don’t waste time on low-impact practice.

Common Parent Questions — Answered

1. Should we hide assets or reduce income to qualify for more aid?

No. FAFSA and CSS Profile require honest reporting. Attempts to hide assets or income can lead to penalties and loss of aid. Instead, focus on legitimate strategies such as reviewing which assets are counted (retirement accounts often aren’t) and consulting financial aid officers if your situation is complex.

2. What if our aid package includes loans we can’t accept?

Call the financial aid office and explain your situation. Many colleges will revise packages in cases of demonstrated hardship. Ask whether grants can replace loans or whether a payment plan is available.

3. Are there hidden fees or expectations tied to institutional grants?

Usually institutional grants are straightforward, but check whether a merit scholarship requires maintaining a certain GPA or full-time enrollment. Some packages are renewable with conditions; understand renewal criteria before deciding.

Real-World Example: How a Small Score Increase Helped One Family

A student named Maya (example) improved her Digital SAT by 90 points after focused work in three months. Her results did two things: 1) made her a stronger candidate for selective merit awards, and 2) increased her admissions chances at a school that packages both need- and merit-based aid. The net effect was lowering family out-of-pocket costs by several thousand dollars per year. That outcome combined steady practice, a tutor who prioritized high-yield content, and applying early to a school where her profile matched their award criteria.

Stories like Maya’s show that incremental improvements — not dramatic leaps — can matter a lot.

How to Talk with Colleges About Financial Aid

Open communication is powerful. When comparing offers, consider calling or emailing the financial aid office with specific, concise questions.

Suggested script for parents

- Introduce yourself and reference the student’s offer letter.

- Share a brief, factual change in circumstances if relevant (job loss, medical expenses).

- Ask if there is room to review the package or if additional institutional grants might be available.

- If comparing multiple offers, politely say that you are weighing competitive offers and ask whether the college can reassess.

Be respectful and prepared — have documentation ready if an appeal is warranted.

Special Consideration: Test-Optional and Test-Blind Policies

Many colleges remain test-optional, meaning students may choose whether to submit scores. A test-optional policy reduces the pressure to test, but a strong SAT score can still be a valuable asset for scholarship consideration where schools permit scores. Test-blind schools don’t consider scores at all; in those cases, test prep has no bearing on admissions decisions for that college, though it could still be relevant for scholarship programs outside admissions.

Resources Parents Should Use (What to Look For)

Reliable college planning tools and guidance are invaluable. Look for:

- Official practice materials for the Digital SAT and clear explanations of test structure.

- College-specific financial aid pages and institutional net price calculators to estimate likely costs.

- Free advising services (e.g., virtual college advising programs) for families who want extra help interpreting award letters and deadlines.

When It Makes Sense to Invest in Tutoring or Test Prep

If your student has realistic potential to raise their score sufficiently to change admissions or scholarship outcomes, investing time and money in targeted test prep can be worthwhile. Effective tutoring should be personalized, focused on the student’s highest-leverage weaknesses, and flexible to their schedule. Sparkl’s personalized tutoring model—offering 1-on-1 guidance, tailored study plans, expert tutors, and AI-driven insights—can make each hour count by zeroing in on the work that will produce the largest score improvements.

Final Checklist for Parents

- Map deadlines for FAFSA, CSS Profile, and college applications.

- Decide whether to submit SAT scores based on each college’s policy and the student’s competitiveness.

- File FAFSA early, and gather tax documents in advance for CSS Profile where required.

- Compare award letters by net price, not sticker price; factor in loan obligations.

- Consider a modest, focused test-prep plan if it could trigger meaningful merit aid.

- Contact financial aid officers promptly if circumstances change.

Closing Thoughts: A Partnership Between Family, Student, and College

Preparing for college is a marathon of small, informed decisions. The Digital SAT is one piece of a larger puzzle — it won’t dictate your family’s financial destiny, but it can open doors to scholarships and strengthen an application. Pair clear financial planning (early FAFSA/CSS Profile completion and careful review of award letters) with focused academic preparation. Lean on available resources, ask questions of admissions and financial aid offices, and when targeted help is needed, consider personalized tutoring options that respect your time and priorities.

With thoughtful planning and a step-by-step approach, families can reduce stress, improve outcomes, and find a college fit that is both academically rewarding and financially sustainable.

Want help creating a test and aid strategy?

Start by listing your family’s top 3 colleges and their aid deadlines, gather financial documents, and set one realistic SAT goal. If you’d like more tailored support, an expert tutor can build a study plan that suits your student’s strengths and schedule — and help translate score gains into real financial benefits.

Good luck — and remember: clarity and steady action beat last-minute panic every time.

No Comments

Leave a comment Cancel